ABOUT THE AUTHOR

Claes Mikko Nilsen is one of the co-founders and builders of FiBAN. Since the establishment in 2010, he was part of raising the awareness towards business angel investing and became well known for his pitch moderator skills. Claes Mikko has been elected twice as the Nordic100’s most “impactful and influential figures of the Nordic tech scene”. He managed Nordic angel network cooperation at NordicBAN and currently works at NordicNinja VC as the Investment Director.

FiBAN is today one of the largest angel networks in the world supporting the Finnish startup ecosystem with a national, vibrant and visible network of private startup investors. The early-stage investment ecosystem in Finland is considered to be in a relatively good shape, and the investment activity exceeds itself each year. The situation was a bit different 10 years ago when Finland realised it was heading towards a post-Nokia driven business society. The eyes started to turn towards a category of young, bold, entrepreneurs that spoke about bigger goals with an attitude of not giving up. This attitude was especially led by Angrybirds Rovio and picked up by university students.

This category also praised risk capital and individuals supporting those bold goals, but it was unclear if Finland could provide these kind of individuals, as the country was very risk averse and entrepreneurship wasn’t the ultimate national goal. To answer this need, the newly established FiBAN was able to gather like-minded individuals to share and develop the Finnish startup investment scene. Today Finland is known around the world for its well-structured angel activity and cooperation, which many times is referred to FiBAN. There have been several initiatives to create similar kinds of angel networks in other countries, but not all have succeeded.

So, to celebrate 10 years of FiBAN activity I was asked to summarize some of the main reasons that led FiBAN to become the national voice and link for Finnish business angels, inspiring and educating hundreds of individuals to the exciting world of startup investing.

The starting point – What affected the uprise of a national angel network

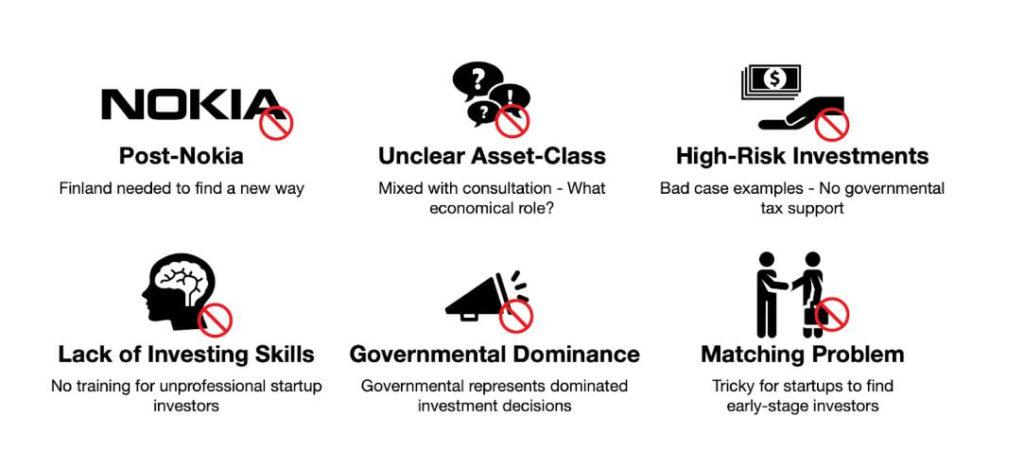

FiBAN got its start in 2010 after a bunch of active startup investors felt that something needed to be done to strengthen the amount and visibility of private startup investors (closer details can be read from the FiBAN history). Below are some of the points that surrounded the environment around angel investing at the time.

The post-Nokia country

Nokia was the dominant technology player in Finland (4% of the Finnish GDP as best) and provided the nation a large group of tech oriented individuals with substantial wealth. Nokia’s decline sparked a national interest to find alternative business solutions. The decline also released a huge amount of smart brains that found themselves in the entrepreneurial path. Very quickly the Nokia decline was considered not to be just bad, but a positive opportunity to rather have 1000 smaller fast moving companies, instead of just one big.

An unclear asset-class

The public angel investing image was relatively negative. There were only a few public angel figures available and a limited amount of research and data. Some of the key startup investor figures even refused to use the term “angel” about themselves. Sitra, which actively supported the early angel activity developed in Finland, predicted that the national investment size of angels was just around 2-5 million euros yearly.

(Too) High-risk investments

There were plenty of examples of failed startup investments made during the millennium change. There were no governmental initiatives encouraging private startup investment (compared to UK and France) and there were even unclear guidelines by the tax authority on how to treat private investors, for example in the case of bankruptcy.

Lack of angel investing skills

Those interested in startup investing had to be very active themselves to find suitable material and information about angel investing. Almost no startup investment trainings. This led to the situation that many made investments based on a gut feeling and not consulting previous experiences before the first investment.

Governmental driven investment decisions

In 2010, the governmental investment agency Finnvera (Vera Ventures) offered direct startup investment service to co-invest with the private sector. There were also pitch events arranged every sixth week to introduce investment opportunities and cases that Finnvera had committed to invest in. The service was appreciated but the feedback was that the structure was too governmental driven. Finnvera’s process was helpful for many startups, but it was also considered unfair that “tax payers money” had to take the biggest risk when there was not enough private capital available.

Matching problem

There were very few events to meet and present investment opportunities to potential investors. One of the main events was “MoneyTalks” by Technopolis, which was a fee-based service. There were also very few visible angel investment profiles or public lists of investors that the startups could contact.

What made the angels fly

In 2010 there was demand for more business angel training, matchmaking, lobbying, and increase of public awareness. The public organisation Finnvera had taken over the angel activity from Sitra and now focused on co-investing. Sitra’s director Risto Kalske approached business angels Juha Kurkinen and Ari Korhonen to establish a privately driven network. The FiBAN association was started with a group of 20 angels and coordinated by Kurkinen’s not-for-profit education company, Rastor, which also covered most of the expenses in the first years.

The interest and technical support was there, but in addition, the following points affected the development of FiBAN and the Finnish angel ecosystem.

Inspiring angel role examples

Finland had the luxury of having some very inspirational pro-startup profiles step up during the time when Nokia and the whole Finnish economy was declining. The larger audience in Finland already knew the startup investment activity by F-Secure’s co-founder Risto Siilasmaa (who later became the chairman of Nokia). Siilasmaa urged all top corporate CEOs to have their own startup investments to better understand the future and “give back” by supporting the next generation. Also Peter Vesterdbacka, the “Mighty Eagle” at the time and one of the Slush founders, inspired the nation to think more boldly. The first angel investor in Supercell, Jari Ovaskainen, inspired many when Supercell reached the unicorn level.

These were individuals that had a big impact due to their public profiles in the Finnish business society. The founding fathers of FiBAN, Juha Kurkinen and Ari Korhonen had active business careers alongside their angel investing, but chose to take private action to encourage in public other individuals in the same position to join the most energizing and fun business activity by investing in startups. They also spoke strongly about the need to build a startup portfolio by spreading the risk and investing in groups.

”Giving Back” mentality

Research showed that 50-80% of all new net jobs were created by small, growth driven companies. Therefore it was almost a patriotic thing to invest in startups and develop new innovation. In addition, too often startups failed due to classic mistakes as the team couldn’t purchase necessary help. Dedicating time and resources with the compensation of company shares required more knowledge, but engaged the individuals more than just mentoring or voluntary help.

Startup role examples

Naturally it all comes down to good startup role models, and Finland was lucky to have Angrybirds and Supercell take the spotlight. For example the founders of Supercell are today the highest individual taxpayers and speak very positively about the startup environment and the private and governmental support they received.

The FiBAN Team

From the very beginning a great amount of angels have contributed with their experience and network to support the FiBAN development. I had the pleasure to coordinate taking those visions into action. We were able to build a self-sustaining network and the first full-time employee was hired in 2012. This allowed us to develop the structure of constant deal flow management and develop additional services. In 2014 the team increased to three persons to cover the three main areas: deal flow management, investment training and lobbying.

Cooperation with the public

The public sector managed most of the appreciated angel services at the time, for example Sitra’s angel network and Finnvera’s pitch sessions and direct investments. It has been in the public sector’s interest to to support private initiatives and as soon as there was a structure developed by FiBAN, the public sector stepped down. For example Finnvera’s pitch events was given over to FiBAN after running the events parallelly for a while. Finnvera also stopped making direct early-stage investments, which allowed governmental support to be used for later stage co-investments.

A Not-for-profit association

FiBAN was from the beginning privately funded and was able to develop a structure which allowed to operate with membership fees. The main activity, the deal flow management was kept free-of-charge, allowing everybody to have a fair change to invest in the deals presented and benefit from the same member services.

Helsinki Spring – University student interest towards entrepreneurship

An interesting twist is of course the startup movement that was actively boosted by students. In 2009 several student entrepreneurship societies were established, like AaltoES, BoostTurku, and StreamTampere. This supported the change of university student attitude towards entrepreneurship and a few years later it was recorded that 40% of students considered entrepreneurship as a strong career alternative. Stanford Professor Steve Blank called the mental shift in 2011 for “the Helsinki Spring”.

Credit rating protection (REF)

One of the most appreciated services was when FiBAN received the status of an official entity allowing its members to apply for the personal credit security, limiting the risk of a portfolio company’s bankruptcy to affect a private person’s credit rating. This service is well functioning even today.

Symbolic tax deduction for angels

As a result of the initiative and active lobbying by FiBAN, the government implemented a three year tax deduction right to inspire angel investors in 2013 – 2015. The deduction model turned out to be less useful as it included too many requirements and the deduction was more of a “tax postponing” than a deduction. Still, the legislation worked as an important symbolic statement when the government started to talk about business angels and their important role boosting innovation.

Angel Trainings & Data

There were relatively little studies made about business angel investing at the time and as mentioned, in 2010 Sitra estimated that the total angel investment activity was around 2-5 million euros yearly. This was quickly changed when the first FiBAN study showed that just the 99 angel respondents alone had invested over 14 million euros in 2012. The data collection has continued ever since and became an important part of the national startup investment statistics gathered in cooperation with Finnish Venture Capital Association.

World class angel events

The Finnish startup events started to grow fast with international interest. FiBAN became a valuable partner linking angel investors to the events and sharing best practices to serve the investor services. Slush’s Investor Day, which today is one of the most important startup investor events in the world, got started from FiBAN’s angel conference held in 2014.

And one more point, which is lacking from the previous list, but has played a crucial role for the network’s activity:

Bonus: “The No Consultation” rule

When we started FiBAN, we created two main rules: 1. The member does not sell his/her own services to other members or startups in the network, and 2. The member aims for financial profit through his/her investment target’s success. These meant that it was expected that the members joined with the aim to make investments, not to find new clients. This was well adopted and supported by the members.

We’ve had a good first decade of angel network activity in Finland and great to see this been acknowledged with awards by European Business Angel Network and the Finnish President. This seems to be just the start as I could be more excited about the current FiBAN team and board that have a really great grip on the activity and the next step goals.

Looking forward to celebrate FiBAN’s first decade at the angel gala in Helsinki 10th of December 2020. See you there!

Claes Mikko Nilsen